Payment Processor vs. Payment Facilitator: What’s the Difference?

Sabine Konhaeuser2023-06-12T12:29:44-04:00

Payment Processor vs. Payment Facilitator: What’s the Difference?

- A payment processor is a financial services company that manages the logistics of electronic payment acceptance, typically acting as an intermediary between banks and merchants.

- A payment facilitator (or PayFac) is a more specific processing model that streamlines the enrollment process by onboarding merchants under a master account.

- There’s overlap between terms, but a payment facilitator usually offers quicker onboarding and simpler, flat-rate pricing.

You set the payment processing cycle in motion whenever you swipe a debit or credit card, “tap” your phone over a contactless terminal, or buy something online. Some of the process is intuitive: you initiate a purchase, and the money is withdrawn from your account. But some of it is not: there is a wide range of players in the payments space, from banks and credit card networks to payment processors and gateway providers, and the “cycle” is not exactly circular. It’s more like a web, linking different entities per their business needs and goals.

The modern consumer’s native familiarity with payments is also curtailed by industry jargon. For the real-life humans working and consulting at B2B and B2C companies, this makes the greater fintech landscape almost impossible to navigate without expert guidance.

One question in particular that we hear repeatedly is, “What’s the difference between a payment processor and a payment facilitator?” There is currently a lot—and we mean a lot—of misinformation online about the distinction between the two, so we’re here to set the record straight.

What is a payment processor?

If you ask six different (self-described!) payment processors exactly what they do and what they offer, you will get six wildly different answers. So let’s start by nailing down a definition.

A payment processor is a type of financial services company that manages the logistics of electronic payment acceptance. Typically, the umbrella of “electronic payments” encompasses a wide (and frequently expanding) range of transaction methods, such as credit and debit cards, bank transfers, digital wallets such as Apple Pay and Google Pay, cryptocurrency, and so on.

The level of support for certain payment methods varies from processor to processor. For example, some might not have the infrastructure to support digital wallet acceptance. As a merchant (or as a consultant or developer for a larger B2B or B2C company), this is something to be on the lookout for: in general, you want to offer your clients the widest range of payment options possible.

Along the same lines, a processor’s inability to support some methods might indicate that they’re not technologically adept enough to grow with you. You want a partner that can meet all of your processing needs, both now and 10 years down the line—a partner that prioritizes cutting-edge software and excellent customer service.

A payment processor’s key responsibilities include the following:

- Establishing merchant accounts

- Accepting and processing payments

- Implementing anti-fraud measures

- Maintaining compliance with PCI DSS (Payment Card Industry Data Security Standard) requirements

To fulfill its core responsibilities, a payment processor typically uses a payment gateway to 1) encrypt and transmit payment details, and 2) communicate transaction approvals and declines. For most merchants, it makes sense to go with a merchant services account and payment gateway from the same provider.

In short: A payment processor provides B2B and B2C businesses with the systems and technology they need to accept payments. By securely shuttling card data between banks and card networks, they enable merchants to securely collect and transfer funds.

What is a payment facilitator?

We’ve established that “payment processor” is a pretty broad term. Since there is no singular authority that determines its proper usage or application, it’s applied pretty liberally in the payments space. Other than the relatively self-evident notion that a payment processor is responsible for—say it with us—processing payments, there isn’t much specific functionality inherent to the term. For this reason, many of us in the payments industry are choosing to use “payment processor” less frequently in favor of more direct, accessible language. This is not to say that the term has somehow fallen out of use (it’s still a part of our everyday vocabulary!), but rather, when a more concrete term is available, we prefer to use that one instead.

Now that we understand what a payment processor is, and we’ve acknowledged that its meaning and usage is largely context-dependent, let’s talk about the payment facilitator model.

The payment facilitator (or PayFac) model is a processing solution that expedites the enrollment process for merchants by onboarding them under an already-established master account. PayFacs embed payments into their own software platforms, which is a fancy way of saying that they directly integrate payment acceptance and management functionality into their products. This gives them control over the transaction life cycle from start to finish, enabling them to serve as a one-stop-shop for a merchant’s payment needs.

Under the PayFac model, the traditional underwriting process is eliminated, allowing businesses to onboard in minutes instead of months. Depending on the provider, pricing is also much more transparent. PayFac-as-a-Service (PFaaS) solutions are generally offered at a monthly flat rate, which allows merchants to know upfront what they’re paying. That’s right—no hidden fees! They also provide the unique opportunity to implement payment monetization strategies. It’s a benefit that’s truly as good as it sounds—PFaaS solutions enable businesses to generate an entirely new revenue stream with little to no upfront cost or development work.

Also, just in case it’s helpful: Another term floating around the payments space is payment aggregator. The main difference between a payment aggregator and a PayFac is the type of merchant ID (MID) used to differentiate accounts. Under the PayFac model, a merchant is set up under the PayFac’s master account, but they are onboarded with their own unique MID. In essence, they become a sub-merchant, and they face fewer complexities when setting up online payments. In contrast, an aggregator signs merchants up under their (the aggregator’s) MID, which has two unfortunate downsides: it allows for less customization and control over the checkout experience, and it increases the likelihood of account holds. This can mean—you guessed it!—unpredictable interruptions to cash flow. In general, the aggregator model is also more expensive for B2B and B2C businesses than PayFacs.

Payment processor vs. PayFac: What’s the difference?

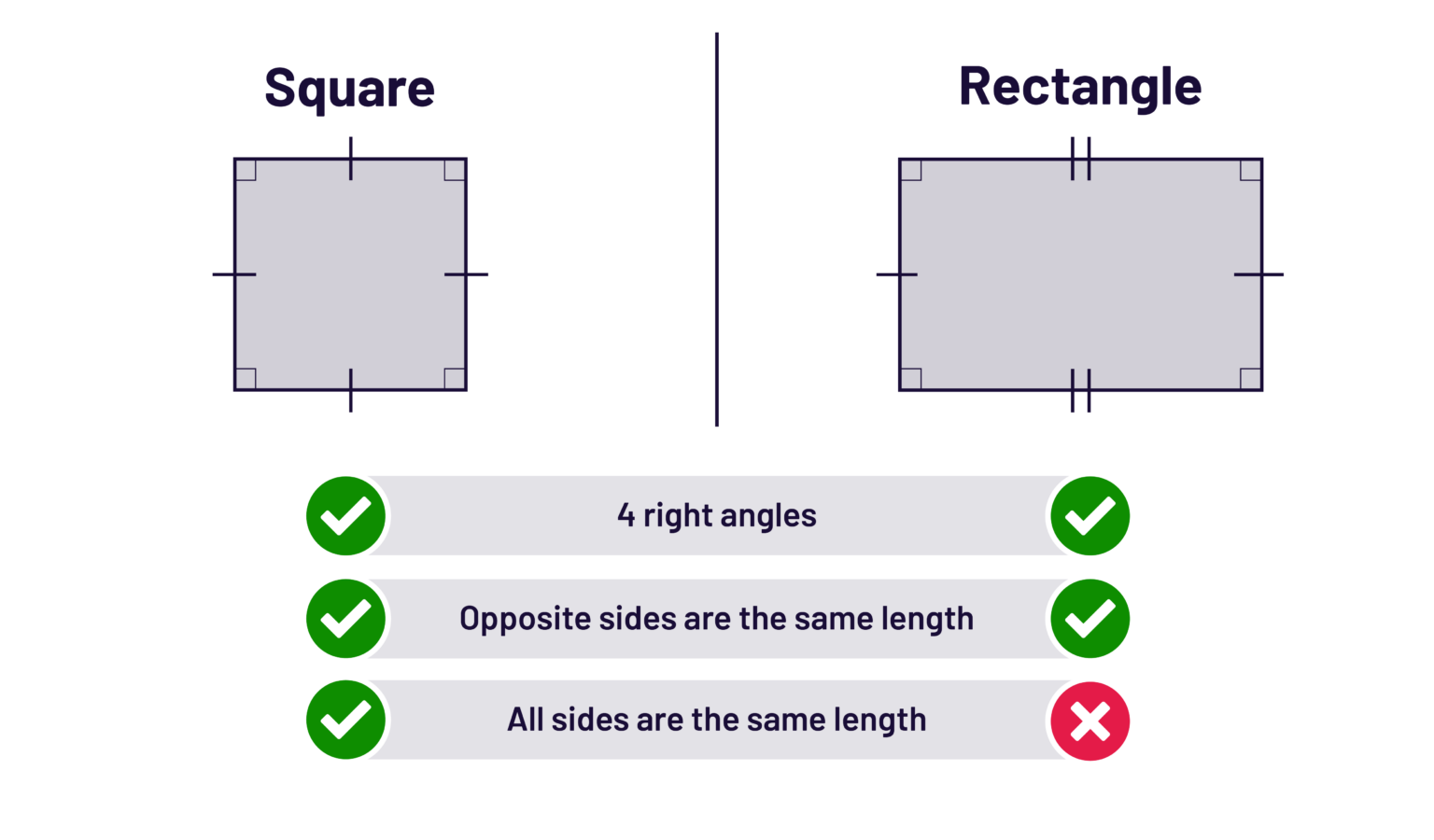

You probably remember from fourth-grade geometry that every square is a rectangle, but not every rectangle is a square. This is a perfect analogy to depict the difference between a payment processor and a PayFac. Not convinced? Stick with us.

If you think back to that geometry class, you’ll recall that a square has all the same qualities as a rectangle, plus some additional features. If we apply this thinking to our original question — “What’s the difference between a payment processor and a payment facilitator?” — here’s what we find:

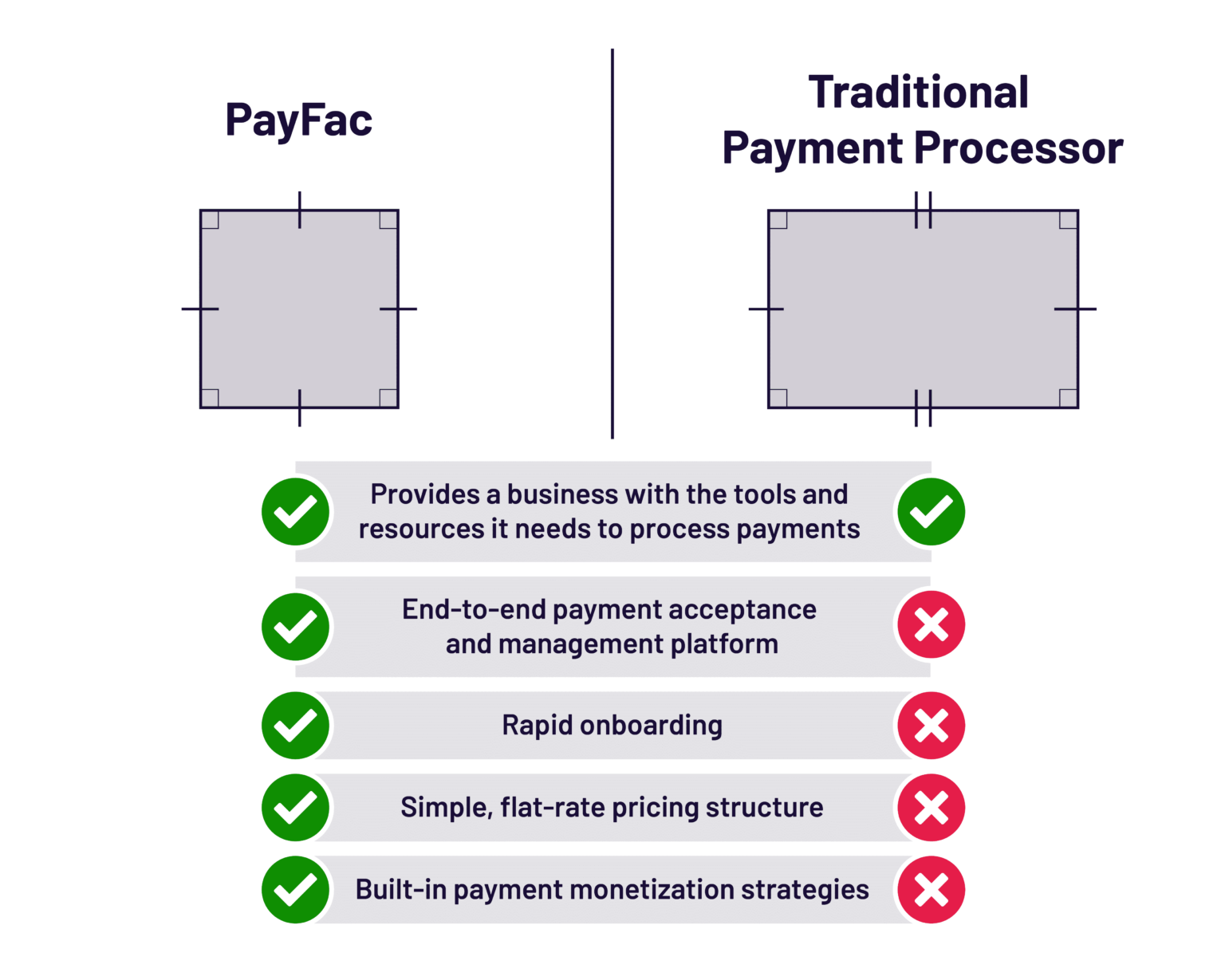

Every PayFac is a type of payment processor, at least in the sense that it provides a business with the tools and resources it needs to process payments. (Note that if you’re using a different definition for “payment processor” than the one we presented earlier on, you might have to scratch this example and come up with one of your own.) But not every payment processor is a PayFac, because “PayFac” is a more defined term with a more specific structure. As you can see in the above diagram, PayFacs have control over the payments process from start to finish, and they enable merchants to generate an entirely new revenue stream.

How Cardknox can help

Whether or not your business could benefit from modern PFaaS offerings, you definitely want a processing partner with an advanced tech stack that offers customizable, easy-to-integrate solutions. We’re here to help with that — just say the word.