ACH Payments

Streamline Your Payment Processing With ACH Payments

Use ACH payment processing to send and receive money quickly, simplify your accounting and reconciliation processes, and improve your cash flow.

New to Cardknox? Learn more →

What is ACH Processing?

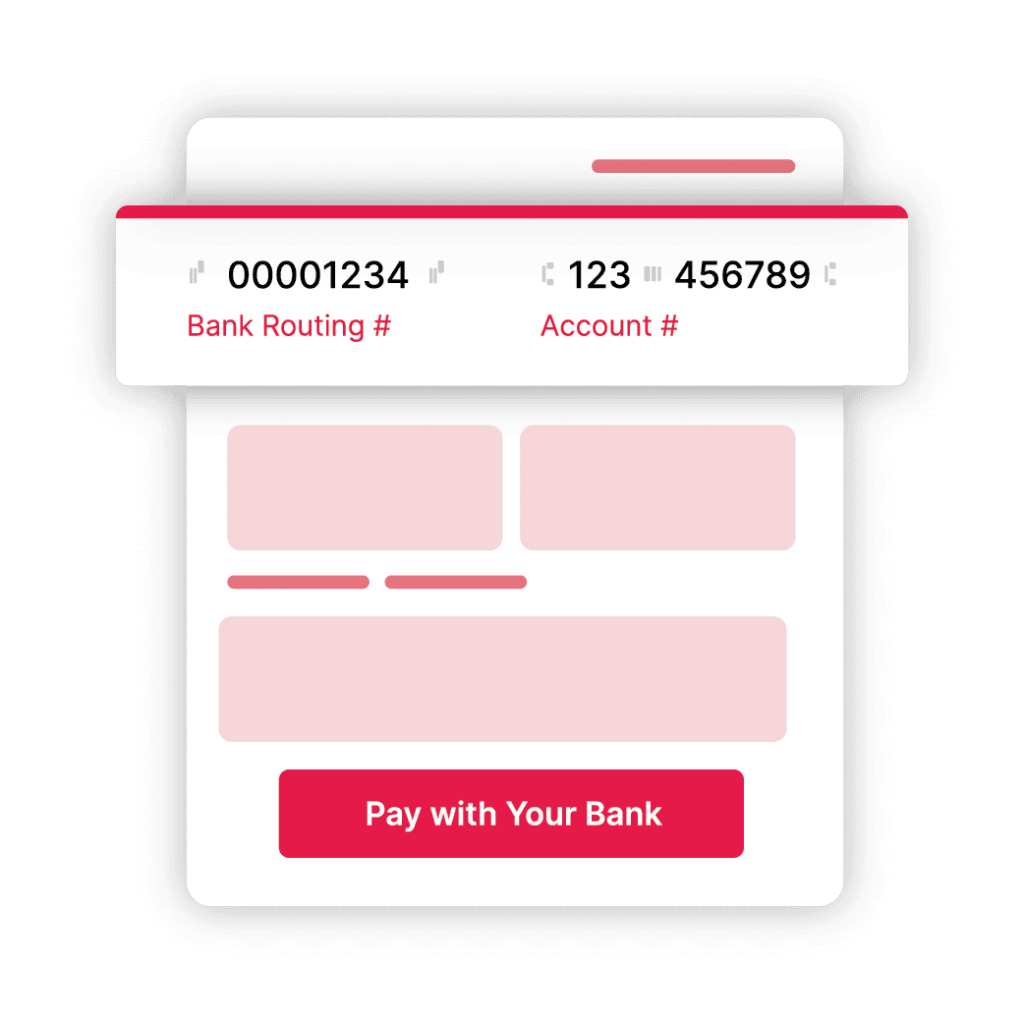

ACH, otherwise known as Automated Clearing House, is the electronic network used to transfer money and payment information between bank accounts. Processing payments through the ACH system is a safe and secure way to transfer funds, and provides both you and your customers with a variety of benefits.

Why Should Merchants Accept ACH Payments?

While credit and debit cards remain the top choice for customers who make online purchases, ACH payment volume continues to grow year over year. Regardless of industry or the types of products or services you sell, ACH processing gives you an easy way to accept and manage customer payments.

If you are a merchant, here are some things to consider as you decide whether to accept ACH transactions at your business.

- Automated Payment Processing Using ACH payment services to set up recurring billing for your customers can help save time, reduce errors, streamline your accounting process, and eliminate the need to handle paper checks.

- Next-Day Funding*ACH supports next-day funding, making it a great option for merchants who need a fast and reliable cash flow (so that overhead costs can be paid headache-free!) Next-day funding can be hard to come by since it’s considered high risk, but fortunately, ACH next-day funding is easy to set up.

*Not currently available for Cardknox Go (Fiserv)

- Works With Our PaymentSITE Online Hosted Form You can accept ACH payments through our PaymentSITE hosted form, a truly frictionless checkout flow that is sure to boost customer satisfaction. This fully secure online form can be used as a standalone payment form or embedded into your merchant site, allowing you to accept ACH payments with tremendous ease. Plus, Cardknox merchants who use our new Merchant Portal can quickly and easily send a PaymentSITE form to process an ACH payment.

- Fast, Affordable Payment Processing ACH processing is easy to implement and inexpensive to maintain. There are no setup fees for ACH, and ACH transfers are typically less expensive than processing paper checks, paying credit card discount fees, and using wire transfer service charges. ACH is an ideal solution for non-profits and other businesses that are looking for ways to lower costs on card-not present transactions.

- Lower Decline Rate Since checking and savings accounts don’t “expire” like credit cards, you will experience fewer payments that are declined because of expiration.

- Customer Convenience Your customers will enjoy the speed and convenience of making secure online payments.

- Safe and Secure Oversight The ACH network is managed by NACHA (National Automated Clearing House Association), a nonpartisan government entity that regulates and oversees the network. NACHA regulations require that businesses that accept ACH payments must ensure the safety and security of the customer’s identity and payment information; however, ACH payments do not have to follow the same PCI (Payment Card Industry) requirements as credit and debit card payments.

- Efficient Cash Flow Management ACH integrates with most types of accounting and bookkeeping software, so no special programming is needed. Plus, payments are credited to your account faster than the time it takes for paper checks to clear, usually within one to five business days.

Are you ready to accept ACH payments and automate your payment processing? Contact us today to learn how to accept ACH payments instantly!