Embedded payments: Everything you need to know

Sabine Konhaeuser2023-09-15T11:45:56-04:00

Embedded payments: Everything you need to know

A seamless product experience is key to maintaining a satisfied, loyal clientele. Embedded payments not only streamline the customer journey but also drive higher conversion rates and revenue growth.

In this article, we’ll cover everything you need to know about embedded payments, including how they work, the benefits, and outlooks for growth and future trends.

What is embedded finance?

Embedded finance is the integration of financial services or products, such as payments, into a non-financial customer experience. In other words, these solutions allow any business to manage and market financial services within their existing products. For consumers, this means easier and more convenient access to money-moving services. For businesses, it’s a way to develop new (and dramatically improved) revenue streams.

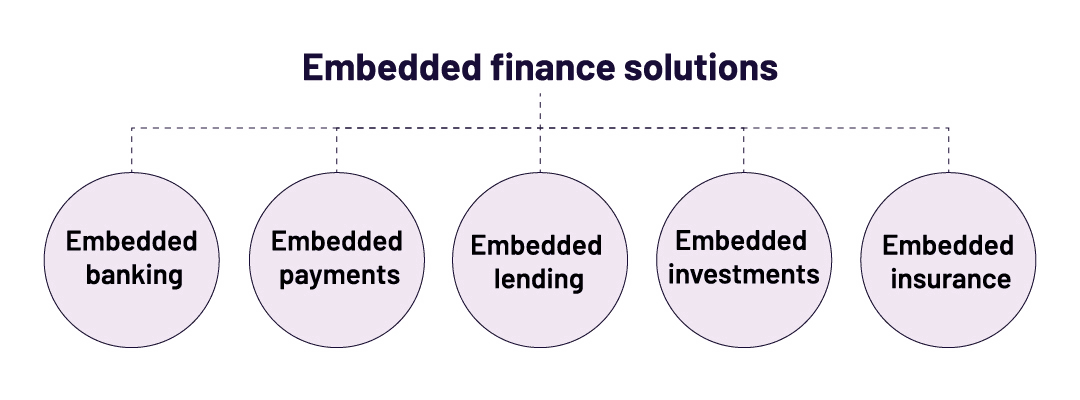

There are many types of embedded finance products and services, including embedded banking (or Banking-as-a-Service), embedded payments, embedded lending, embedded investments, and embedded insurance.

What are embedded payments?

A subset of embedded finance solutions, embedded payments enable customers to complete their transactions directly within a platform’s website or app. In turn, these solutions allow businesses to maintain full control over the customer experience—all the while they’re earning new revenue from processing fees. Thus, embedded payments offer greater convenience for customers and greater profits for businesses.

How do embedded payments work?

Embedded payment solutions are fully integrated within a company’s product. In the past, the common method of bringing payments in-house involved building a payment gateway or processor into the platform itself. As you can imagine, this ground-up integration came with often-insurmountable costs and development work. Fortunately, the PayFac-as-a-Service (PFaaS) model has completely revolutionized the payments industry. This new model provides all the benefits of embedded payments without the complexities. Businesses simply work with a PFaaS provider that enables them to use certain financial products, allowing them to run the services without having to build and maintain their own infrastructure.

For more on the benefits of PFaaS solutions, check out this guide to monetizing payments.

What are the benefits of embedded payments?

Embedded payments have a lot of upsides. When you integrate a PFaaS solution into your platform, you can count on:

- A new revenue stream from processing fees.

- Lower churn due to streamlined customer experience.

- Higher conversion rates, especially in competitive industries like retail and direct-to-consumer (DTC).

- Better data and analytics that offer insightful customer information.

- Streamlined compliance.

The future of embedded payments

The embedded finance market is valued at $63.2 billion in 2023, and it’s expected to grow to $291.3 billion by 2033. That’s a compound annual growth rate of 16.5%!

Many factors are driving embedded finance, including the ever-increasing popularity of digital platforms and the growth of mobile commerce. In the past decade, B2B fintech solutions have become deeply ingrained with daily life. As financial institutions prioritize digital transformation over legacy systems, embedded payment technology is set to open doors for organizations of all sizes.

How Cardknox can help

Cardknox offers a comprehensive suite of tools and services for businesses to boost revenue and integrate payments across in-store, online, and mobile channels. In addition to our traditional referral partner program, we offer a cutting-edge PFaaS solution called Cardknox Go.

Contact us today to get started.