Rethinking the payments stack: Key components and how to optimize

Sabine Konhaeuser2024-01-10T11:12:27-05:00

Rethinking the payments stack: Key components and how to optimize

In the fast-paced realm of digital transactions, the payments landscape is constantly evolving. As technology advances and consumer expectations shift, businesses of all sizes find themselves facing new challenges and opportunities. One crucial aspect that demands attention is the payments stack — the infrastructure responsible for processing, authorizing, and securing transactions.

In this blog post, we rethink the payments stack, dissecting its key components and exploring strategies to optimize its functionality.

What is a payments stack?

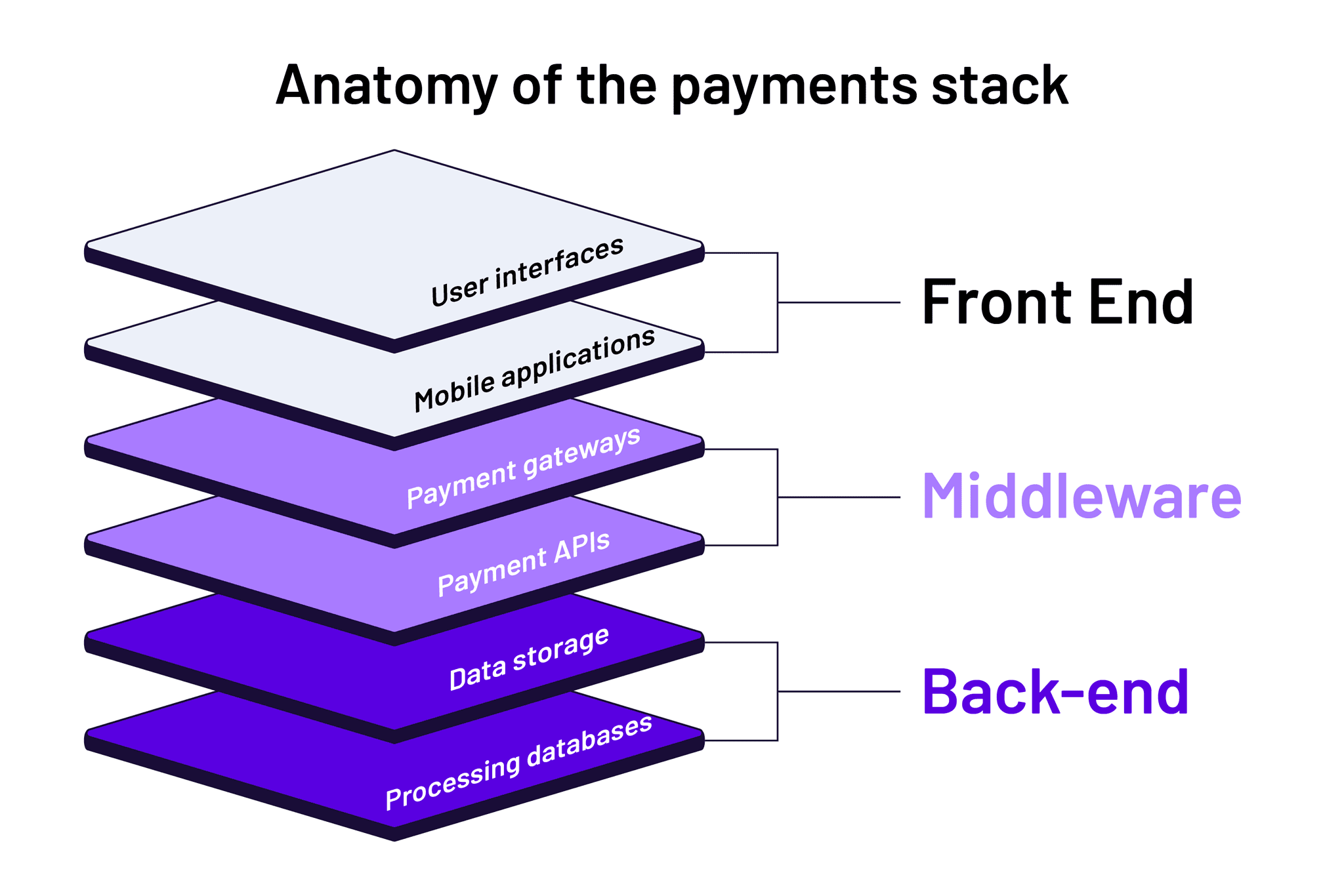

The concept of a payments stack derives from the concept of the technology stack (or “tech stack”). In software development, a tech stack includes all the software and tools needed to support a business or one of its functions. The stack comprises three layers: the front-end, the back-end, and the middleware. The middleware serves as “software glue” that bridges an operating system with the applications running on it.

The anatomy of the payments stack is similar. The front-end encompasses user interfaces and mobile applications, while the middleware involves payment gateways and APIs, and the back-end manages processing and databases.

The modern payments stack is witnessing a transformative shift, influenced by emerging technologies such as contactless payments and AI. These innovations are reshaping the way transactions occur, emphasizing speed, security, and user experience.

Key components of a payments stack

To achieve an optimized payments stack, companies should focus on a specific collection of technologies and capabilities. (Note that an ideal payment processor will offer these components as bundled solutions.)

Payment gateway

The payment gateway is the cornerstone of a modern payments stack. It enables merchants to authorize the payment method (whether that’s a credit card, debit card, or digital wallet) and securely transmit data between the customer, merchant, and payment processor.

Payment APIs

The payment API serves as a bridge between the merchant’s platform and the payment processor. Providers offer distinct API sets with diverse features, which is why it’s important to select a partner who offers solutions aligned with your business requirements.

Fraud management system

E-commerce merchants need advanced authentication solutions that stop fraud in its tracks. The industry standard is currently 3-D (Three-Domain) secure, a card-not-present protocol that removes friction and speeds up checkout.

Risk and compliance solutions

Staying compliant with ever-changing regulations is not just a legal requirement but a mainstay of trust. Businesses must implement robust compliance checks, ensuring data privacy and regulatory compliance.

Checkout interface

The most important front-end component is the checkout interface, where customers input their information. In terms of functionality, it should offer comprehensive payment acceptance. In terms of design, it should be streamlined, intuitive, and secure.

Mobile applications

To easily accept payments, you want a mobile point-of-sale (mPOS) solution that enables you to accept and manage money without a ton of equipment — or even on the go! A robust mobile app accepts all major card brands and payment methods; supports void, adjust, and refund commands; and offers powerful customer analytics that you can use to continuously shape your payments strategy.

Strategies for optimization

Now that we have a solid understanding of the key components, let’s explore actionable strategies to optimize your payments stack for peak performance.

Take an API-first approach

Once you’ve evaluated your business requirements (e.g., what types of payments you accept, your typical volume of transactions), you’ll have to look at the technical solutions available and choose a provider. The ideal partner will prioritize 1) an API-first approach, and 2) compatibility across platforms, both of which are essential for a seamless and user-friendly experience. Scalable infrastructure ensures that the payments stack can adapt to growing transaction volumes without compromising performance.

Implement continuous monitoring and updates

The digital landscape is dynamic, and so should be your payments stack. Regularly updating software, security protocols, and monitoring for potential issues are crucial for staying ahead of emerging threats and technology changes. A proactive approach to maintenance ensures the continued resilience and efficiency of your payment infrastructure.

Prioritize robust security measures

In an era where cyber threats loom large, ensuring the security of transactions is paramount. Tokenization and multi-factor authentication are foundational elements in building a robust defense against fraud and unauthorized access.

Systematize UX enhancement

The user experience is a key differentiator in the competitive payments market. Streamlining checkout processes, minimizing friction, and personalizing interactions contribute to positive user interactions. Investing in modern design principles can lead to increased customer loyalty and satisfaction.

Future trends in payment systems

The payments landscape is shaped by technological advancements and changing consumer preferences. To stay competitive, businesses must anticipate and adapt to future trends. Here are some predictions for the next wave of innovations.

Internet of Things (IoT) integration

As more devices become interconnected, the Internet of Things (IoT) is poised to play a significant role in payments. From smart homes to wearable devices, transactions will become seamlessly integrated into daily life, with payments occurring in the background — driven by real-time data and user preferences.

Biometric authentication

The era of passwords and PINs may be waning as biometric authentication gains prominence. Facial recognition, fingerprint scanning, and other biometric technologies offer a secure and user-friendly way to verify identities, reducing the risk of fraud and enhancing the overall payment experience.

How Cardknox can help

The nature of ACH payments makes them well-suited for the fast-paced and interconnected world of modern finance, providing a reliable means for the quick transfer of funds. Fortunately, Cardknox offers robust, cost-effective solutions that make ACH solutions easy to implement. Contact us today to get started.