Business-to-business ACH: How it works and why it’s worth it

Sabine Konhaeuser2024-02-13T11:33:28-05:00

Business-to-business ACH: How it works and why it’s worth it

The efficiency of payment processing plays a critical role in the success of business-to-business (B2B) ventures. As decision makers strive for seamless and cost-effective solutions, ACH payments emerge as an ideal alternative to traditional paper-based methods. In this blog post, we explore the role of ACH in facilitating secure, quick, and efficient transactions, leading to improved cash flow management and enhanced operational effectiveness in B2B commerce.

Business-to-business ACH explained

The Automated Clearing House is the primary network that businesses use for electronic funds transfer (EFT). ACH payments are made online, with money being debited and deposited electronically between financial institutions. For a refresher on the technology that powers ACH payments and how they differ from wire transfers, check out ACH payments explained: A crash course for businesses.

Most commonly used for direct deposit of payroll, ACH can also facilitate seamless B2B transactions. For subscription-based services, in particular, ACH payments can reduce churn. This is due to the enduring nature of bank accounts — they never expire, and it’s rare for a client to change their primary account. Accounts payables can also be automated with ACH processing, simplifying transactions between your business and its vendors or service providers. This enables better cash flow management, easier reconciliation, and more streamlined reporting.

Opting for ACH to pay supplier invoices, bills, and business expenses, as well as receiving payments for goods and services, is a secure, dependable, and cost-effective alternative to checks, saving both time and money for your business.

How do business-to-business ACH payments work?

ACH allows businesses to efficiently make payments for services without relying on credit or debit cards. Instead, payments are completed directly through ACH, transferring funds from the payer’s account to the payee’s account.

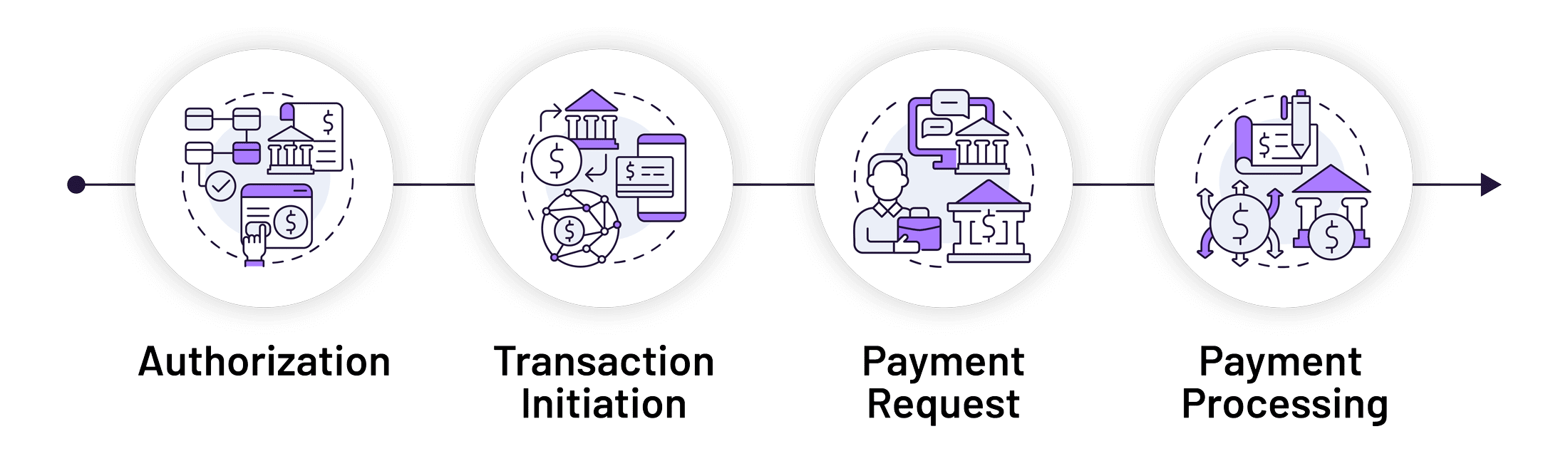

The process of B2B ACH transactions typically involves four steps: authorization, transaction initiation, payment request, and payment processing. For instance, in a B2B scenario, a business may provide an authorization form or portal link to its client for entering banking information. When it’s time to initiate a payment, the initiating business sends an ACH debit request to its bank. The receiving business then forwards the payment and banking details to the ACH provider or financial institution. In this example, the Originating Financial Depository Institution (OFDI) communicates with the Receiving Financial Depository Institution (RFDI) to withdraw the funds.

Due to their automated nature, B2B ACH payments are particularly suitable for businesses with recurring bills from multiple clients.

Benefits of ACH payments for businesses

ACH payments provide faster processing times and fund transfers compared to traditional paper checks, ensuring rapid delivery of payments. They also allow for flexible scheduling options for recurring methods, ensuring predictable schedules that improve cash flow management. By eliminating the float time associated with paper-based transactions, ACH payments further streamline the funds transfer process and reduce risk of fraud.

Choosing the right partner for ACH payment processing

When choosing the right partner for ACH payment processing, it’s important to look for a provider that adheres to industry regulations and offers robust security measures to protect sensitive financial data. Additionally, make sure to seek integration capabilities that meet the requirements of your existing systems, such as your accounting software or customer relationship management (CRM) platforms. The right partner will align with your business needs and facilitate a smooth transition for your clients.

How Cardknox can help

Cardknox offers robust, cost-effective solutions that make ACH solutions easy to implement. Contact us today to get started.