ACH payments explained: A crash course for businesses

Sabine Konhaeuser2023-12-06T14:37:42-05:00

ACH payments explained: A crash course for businesses

Growth-minded businesses are always seeking more efficient, profitable ways to process and transfer money. In recent years, one method that has gained prominence is ACH payments. In this blog post, we provide a crash course for businesses on ACH, including what it is, how it works, and how Cardknox can help.

What is ACH?

First off, ACH stands for Automated Clearing House, which is a centralized financial network. ACH serves as an intermediary between financial institutions in the US, including banks and credit unions, that facilitates the processing of electronic payments. The most common examples of ACH-powered credit transfers include direct deposit of payroll, social security benefits, and tax refunds.

ACH payments offer a streamlined and automated alternative to traditional transfer methods. Unlike credit card transactions that rely on card networks or paper checks that require physical processing, they operate only through an electronic network. This expedites the payment cycle and reduces the reliance on manual intervention, making ACH payments a great choice for bill payments and B2B transactions.

ACH payments vs. wire transfers

Sometimes, businesses find themselves at the crossroads of choosing between the immediacy of wire transfers and the cost-effectiveness of ACH payments. Below we list the key distinctions between these two methods, delving into speed and cost considerations.

Speed

Wire transfers have long been the go-to choice for urgent transactions, particularly when it comes to international or large-sum processing. They ensure that funds are moved in as little as a few hours (and as many as two days). ACH payments can take slightly longer, between one and four days, and are only available in the US.

Historically, wire transfers tended to be faster than ACH transfers. But now, thanks to certain regulatory changes, the difference is often negligible.

Wire transfers are settled on business days when the Fedwire Funds Service (powered by the Federal Reserve) is open. Currently, their processing schedule is Monday through Friday from 7:30 a.m. ET – 6:30 p.m. ET, excluding federal holidays.

ACH payments, on the other hand, are processed through a network called Nacha. In recent years, Nacha has undergone significant operational enhancements and improvements, bolstering its efficiency and expanding the array of services it offers. The network now operates 23 ¼ hours every business day, with payments settled four times a day. Its next-day processing schedule allows for payments as late as 2:15 a.m. ET to be settled at 8:30 a.m. ET. Furthermore, Nacha has also implemented three different same-day ACH processing schedules, showcasing its commitment to providing timely and flexible payment solutions.

In the end, processing times can and do vary. It all depends on how the ACH and Fedwire networks settle out transfers.

Cost

Businesses opting for wire transfers pay a premium for the quick movement of funds: up to $35 for domestic transfers and between $35–$50 for international ones. At most, ACH payments only cost a few dollars. This is why for businesses engaged in routine transactions, ACH often emerges as a low-cost solution.

The technology behind ACH payments

The ACH network facilitates the transfer of funds from one financial institution to another. Overseen by Nacha and other governing associations, ACH has played a pivotal role in modernizing financial transactions by ensuring the swift and accurate movement of money.

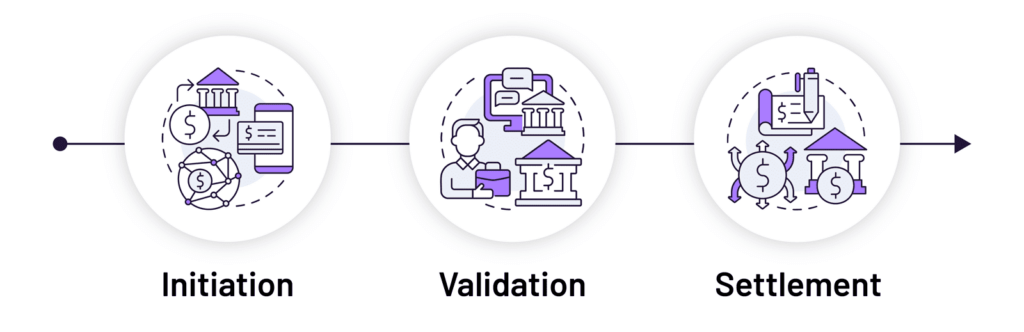

The journey of an ACH transaction begins with initiation, often prompted by an online payment. Once initiated, the payment details are conveyed to the appropriate financial institution through the ACH network. Next, the ACH network serves as a mediator, validating the transaction details, checking for sufficient funds, and ensuring compliance with regulatory requirements. Finally, the money is routed to the recipient’s financial institution. This last step, known as settlement, involves the actual movement of funds from the sender’s account to the recipient’s account.

This flow illustrates how the ACH network transforms manual, time-consuming transactions into a seamless, automated process.

How to accept ACH payments as a business

A robust payment gateway allows businesses to integrate ACH processing into their digital platforms, from e-commerce websites to web-based portals. This is why choosing a partner with an advanced tech stack and comprehensive developer support is critical.

Providing clientele with an intuitive and hassle-free experience is also a must. When introducing a new payment solution, businesses should prioritize clear communication, easy navigation, and transparent instructions. Again, the right partner will be on deck to provide insight and guidance at each stage of the implementation process.

Are ACH payments expensive?

In general, ACH payments incur lower fees than traditional methods like wire transfers or credit card transactions. Because of the reduced need for manual intervention (and the associated operational fees), businesses can use ACH payments to realize substantial cost savings — especially when it comes to high-volume, routine transactions.

How Cardknox can help

The nature of ACH payments makes them well-suited for the fast-paced and interconnected world of modern finance, providing a reliable means for the quick transfer of funds. Fortunately, Cardknox offers robust, cost-effective solutions that make ACH solutions easy to implement. Contact us today to get started.