What is revenue recognition?

Sabine Konhaeuser2023-08-10T11:06:43-04:00

What is revenue recognition?

A comprehensive overview

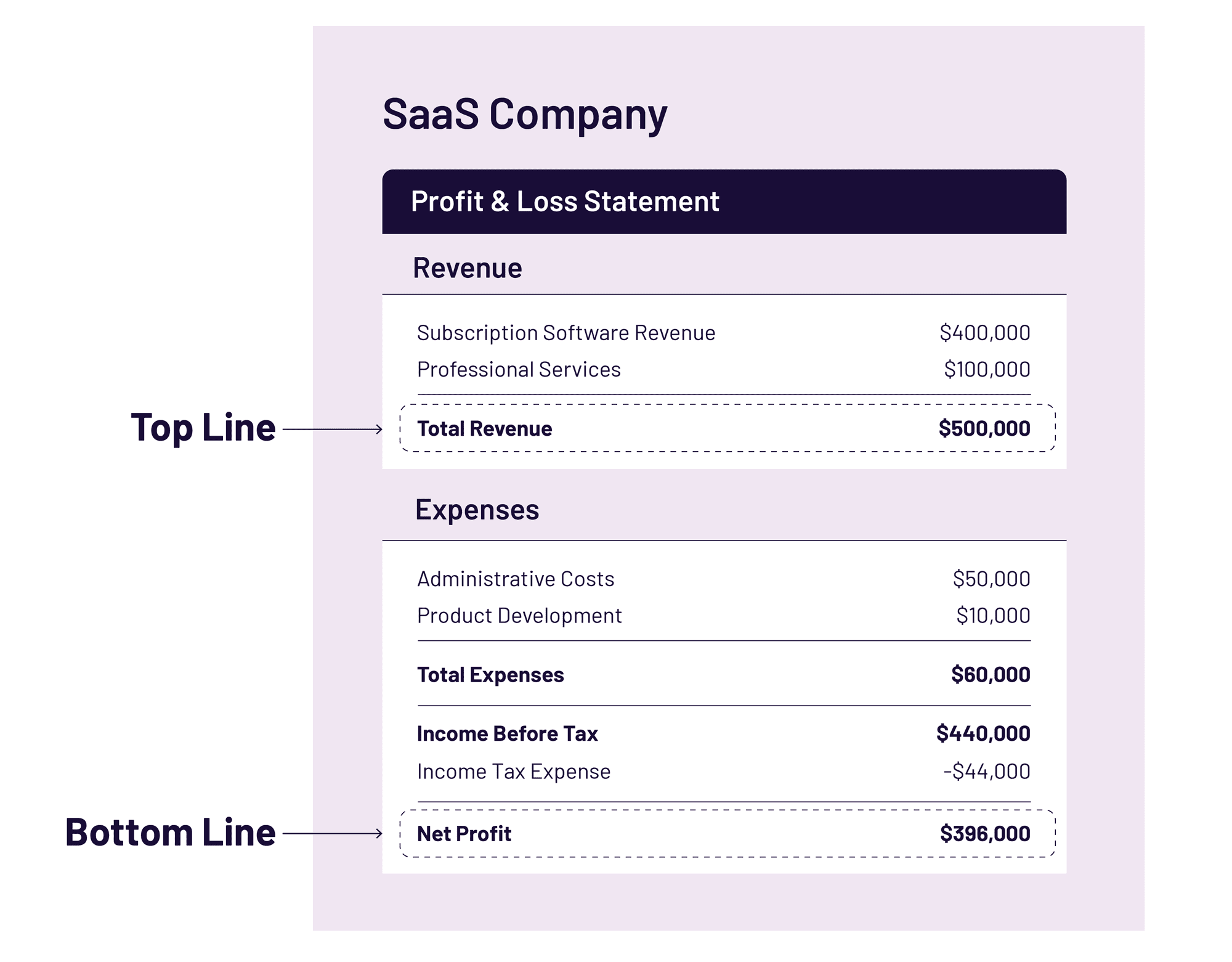

In the dynamic world of business, one term reigns supreme—the elusive “bottom line.” Shorthand for a company’s net income, the bottom line gets its name from its placement on a financial statement, which is (you guessed it!) at the bottom.

We talk less about the top line, which references the gross figures reported by a company—aka, revenue. A company that increases its revenue is said to be generating top-line growth, and that growth is a key indicator of the company’s future outlook in the marketplace.

For businesses looking to fundraise, get a loan, or increase their valuation, it’s essential that they recognize and record their revenue according to best accounting practices. Although accounting may not be the most glamorous aspect of the business world, possessing a fundamental grasp of cash versus accrual is undeniably essential. This knowledge forms the bedrock for leveraging the revenue recognition principle, ultimately propelling your top line to new heights.

But what is revenue recognition, anyway? Read on to learn more about the fundamental workings of this system, how it’s regulated under U.S. guidelines, and how you can harness its power to hit performance targets and attract investors.

Cash vs. accrual accounting

The revenue recognition principle is not as confusing as its 10-syllable name might suggest. In simple terms, it stipulates when and how businesses record (or “recognize”) their earnings. Practical application of this principle, however, is much more difficult to navigate. Nine times out of ten, it’s best discussed with trusted advisors.

But let’s start with the basics. In general, there are two ways that businesses can manage finances and approximate tax liability, and that’s through cash accounting or accrual accounting. What’s the difference between these two methods? Well, it all comes down to timing.

If you record revenue or expenses when you pay or receive money, that’s cash accounting. On the other hand, if you do it when you pay a bill or receive an invoice, that’s accrual accounting. Depending on the size and complexity of the business, one method will generally be better than the other. But for most companies, especially those with recurring revenue or large inventories, accrual accounting is the standard.

Under the accrual accounting method, businesses must recognize streams of revenue when they’re earned and expenses when they’re billed—not necessarily when cash is received. If you’re confused, you’re not alone.

This is where the revenue recognition principle comes into play.

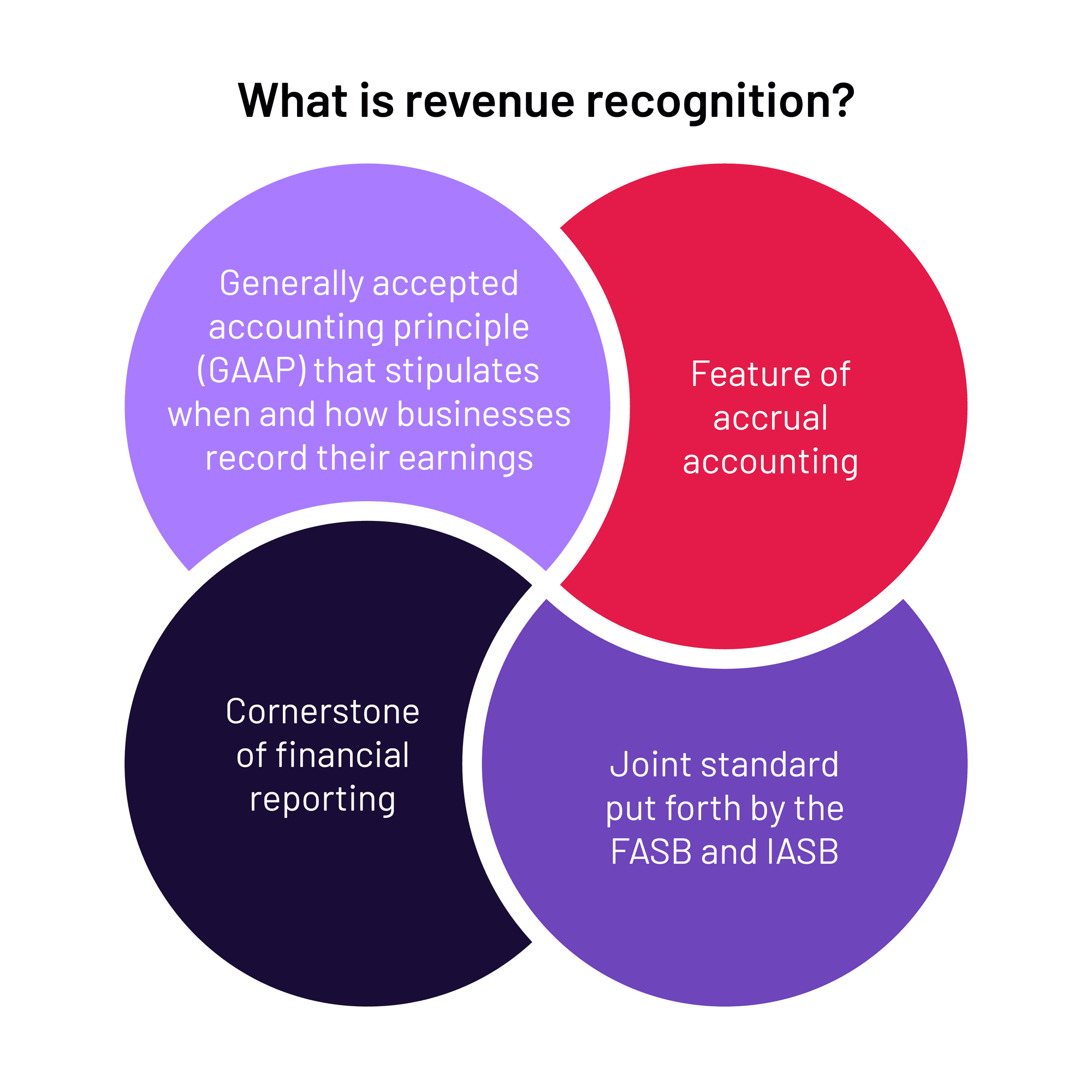

What is revenue recognition?

In the past, because global accounting policies were industry-specific, standards on when and how to recognize revenue were difficult to implement. For investors, this made it challenging to compare the performance of companies across verticals.

That’s why two regulatory boards, the Financial Accounting Standards Board (FASB) and the International Accounting Standards Board (IASB), created a new, shared framework for revenue recognition across business models. Internationally, this framework is known as the IFRS 15. In the US, we refer to it as the ASC 606.

The FASB is responsible for maintaining Generally Accepted Accounting Principles (U.S. GAAP). Similarly, the IASB is responsible for maintaining International Financial Reporting Standards (IFRS).

How it works under U.S. guidelines

On May 28, 2014, the FASB and the IASB issued Accounting Standards Update No. 2014-09, Revenue from Contracts with Customers (Topic 606). This joint standard was devised to provide clearer guidance on how to recognize revenue.

Post-issuance, the FASB and IASB (known colloquially as the Boards) established a resource group for entities implementing ASC 606. In the years since, many amendments have been issued to clarify the standard, but the core principle remains the same.

It establishes that a business should recognize revenue when the control of goods or services is transferred to the customer. In other words, revenue should be recognized as a company satisfies its performance obligations.

Five-step revenue recognition model

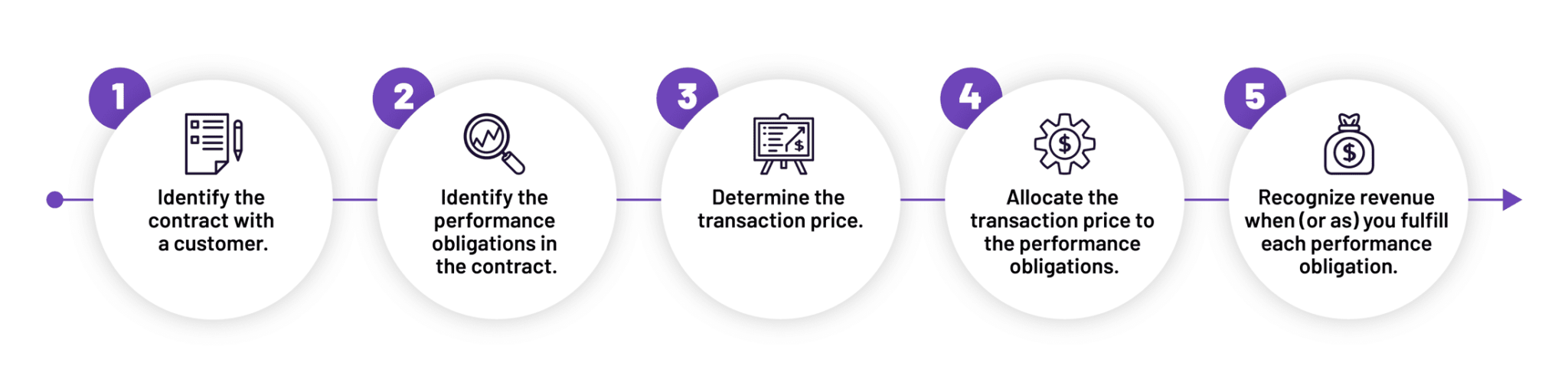

The ASC 606 standard requires businesses to adhere to a five-step revenue recognition model.

Step 1: Identify the contract with a customer.

To recognize revenue, a business must begin by identifying the contract with a customer. ASC 606 guidance defines this contract as an agreement between two or more parties. This agreement must create enforceable rights and obligations.

Step 2: Identify the performance obligations in the contract.

Next, the business must identify the performance obligation(s)—aka, the promise of the transfer of goods or services to a customer—in the contract. These performance obligations can be individual or combined, and the distinction will help determine whether the business, in accounting terms, is an agent or principal.

Step 3: Determine the transaction price.

In addition to the money exchanged with a customer, there are also variable considerations included in the transaction price, such as potential discounts or the right to return.

Step 4: Allocate the transaction price to the performance obligations.

Each performance obligation needs a specific selling price. For variable considerations, businesses are responsible for estimating the price based on expected value.

Step 5: Recognize revenue when (or as) you fulfill each performance obligation.

No revenue should be recognized until the performance obligation is complete. However, for subscription businesses, revenue can be recognized evenly throughout the service period.

How the ASC 606 standard impacts the payments industry

In payment processing transactions, the classification of a performance obligation (individual vs. combined) is of critical importance.

An individual performance obligation can be fulfilled independently, regardless of other promises in the contract. Because it stands alone, it represents a distinct unit of account. In contrast, a combined performance obligation involves multiple, interrelated promises in a contract. These promises need to be fulfilled together in order to provide the customer with the expected value. For this reason, this “bundle” of obligations is also considered a single unit of account.

Okay, okay—but what does this individual versus combined distinction even matter? Who cares how your company classifies its performance obligations?

Well, to put it bluntly—you should. And here’s why:

This classification of a performance obligation determines whether the business is a principal or an agent. A principal of a performance obligation will recognize revenue at the gross amount. An agent will recognize revenue at the net amount. To break it down further, a principal will usually present fees paid to other parties as a cost of revenue. An agent will present fees as a reduction of revenue. Agents typically carry lower risks and lower costs, but they also face a lower growth ceiling.

Is it always better to be a principal than an agent? No, but typically a principal has greater control over the goods and services being transferred, more direct interaction with customers, and potential for higher revenue, which—as we’ve already discussed—can help attract investors or meet performance targets.

Hypothetically, let’s say that you’re a startup SaaS company generating $100,000 per year on traditional referral revenue. You’d be considered an agent. That $100,000 per year would be recorded on your balance sheet as “other income,” but you’d get no additional benefit from it. However, if you’re a startup SaaS company operating as a payment facilitator (or PayFac), then you could be considered a principal. This is because, as a PayFac, you own risk, have control over pricing and product delivery, and so on.

What’s more: In this example, your valuation as a startup SaaS company would be based on multiples of predictable revenue. This means that by adhering to best revenue recognition principles, you would be able to dramatically increase your company’s valuation.

Remember that it’s always best to consult a licensed expert for final determination of performance obligations (and perhaps most importantly, the principal vs. agent distinction). A trusted advisor will be able to guide you through the sometimes-murky waters of ASC 606 implementation and give you the tools you need to make the right decision for your business.

How Cardknox can help

For executives looking to scale their companies, GAAP-compliant revenue recognition practices and financial statements can open up new funding options (often at a lower cost than would otherwise be possible). To learn more about our PayFac solutions—and how they can enable businesses to record more top-line revenue—contact us today.