A PayFac Solution Offering Full Control and Maximized Earning Potential

A robust PayFac-as-a-Service solution for ISVs and developers.

A Simplified Path to Integrated Payments

Deliver better user experiences and start earning more. Cardknox Go equips you with everything your business needs to become a payment facilitator (PayFac): software, compliance, risk monitoring, and more.

With Cardknox Go, there’s no need for a large upfront capital investment, high levels of risk exposure, or complex infrastructure like traditional payment facilitator models.

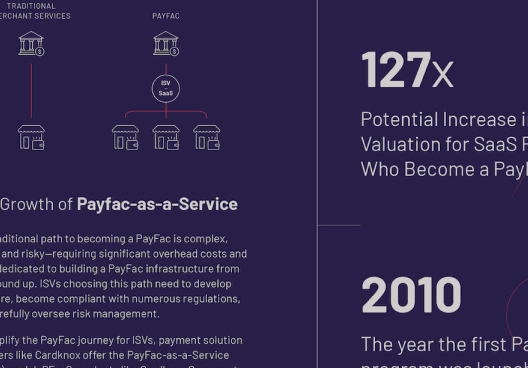

Becoming a PayFac has typically been complex, costly, and risky—requiring significant overhead expenditures and years dedicated to building infrastructure.

ISVs choosing this path often need to develop software, become compliant with numerous regulations, and carefully oversee risk management.

Fortunately, Cardknox Go provides all the tools you need to get up and running fast without the hassle of the traditional PayFac journey.

Cardknox Go:

Fast-Track to PayFac

Experience the rewards of becoming a PayFac without the costly upfront time and capital investments.

Maximized Earning Potential

Enjoy a more predictable income stream—SaaS providers that become PayFacs have the potential to increase revenue by 14x.*

*According to Markets Insider

Lowered Cost of Entry

Significantly reduce costs instead of investing millions of dollars in payment infrastructure.

Hassle-Free Integrations

Easily customize your embedded payment integration using our powerful API and SDKs. Or, for a quicker path to payment acceptance, leverage our plugins for popular software, existing integrations, and emulators for third-party gateways.

Rapid Time to Market

Get started in months versus years, as you won’t need to build technology and establish relationships from the ground up.

End-to-End Control

Manage every step of the merchant onboarding process, enable instant account approvals, and implement seamless checkouts with embedded payments for full control over the user experience.

Reduced Risk

Cardknox shares in payment processing risk instead of ISVs assuming all the risks of becoming a traditional PayFac.

Centralized Merchant Management

Manage leads, onboard new accounts, generate support tickets, and handle disbursements from one online hub.

White-Glove Customer Service

One quick call to our in-house developer support team gets you the expert help you need to serve your merchants.

Stand Out with the Benefits Merchants Want

While you benefit from revenue sharing, improved user experiences, and reduced risk, your merchants will enjoy hassle-free payment processing technology at competitive rates.

- Seamless Onboarding

Simply send your merchants a form URL or use our Account Onboarding API to create an embedded form within your software. - Instant Account Approval

Merchants can skip the manual underwriting process and enjoy instant account approval. - Simple, Flat-Rate Pricing

Transparent and consistent pricing gives your merchants the predictability to easily manage overhead costs. - Cutting-Edge Payment Technology

Leverage the latest payment methods across in-store and online sales channels, and offer advanced tools like online payment forms, a merchant portal, and a powerful mobile app.

How to Become a PayFac with

| 1 | Apply for a Cardknox Go Account |

| 2 | Integrate with Cardknox |

| 3 | Seamlessly Onboard Merchants |

| 4 | Approve Merchant Accounts Instantly |

| 5 | Start Processing Payments |