Case Study

How a leading medical practice software was able to provide clinics and their patients with an upgraded payment processing experience

eMedical and Cardknox

eMedical Practice is a comprehensive cloud-based software that provides medical practices with all the tools they need to manage their business: electronic health records (EHR), eRx, eLabs, billing, telemedicine, a patient portal, and more. Founded in 2013, eMedical Practice is chosen by clinics of all types and sizes across the U.S. for its ability to streamline operations and improve patients’ healthcare experiences.

The Client

Efficiency in healthcare delivery brings with it several challenges that eMedical Practice needs to overcome. Among the most prominent of these challenges is integrated billing functionality. At present, eMedical offers businesses three (3) distinct ways to accept payments:

E-Payments

E-Payments is eMedical’s integrated credit card processing solution. With the help of E-Payments, clinic employees can process credit card payments that are swiped on a payment terminal in-person, or by keying in payment information that’s shared over the phone or in-person.

Registration Kiosks

eMedical’s Registration Kiosk application enables patients to pay seamlessly when checking into a clinic by using an on-site iOS or Android device.

Patient Portal

eMedical’s Patient Portal is an online application that allows patients to pay their outstanding balances. Billing can be done electronically via email, and the patient can pay online with any method they prefer.

Despite the plethora of payment options that eMedical has provided for its patients, there’s no guarantee that these methods won’t have hiccups. eMedical has faced several hurdles in implementing these solutions, leading to a less streamlined bill-pay experience than the company initially hoped. We will now discuss several of these challenges.

Challenges

As a software solution for health clinics, eMedical strives to provide technology that eliminates the hassle and frees up manual labor for clinic staff while improving the patient experience. Unfortunately, its existing payment solutions were not presenting this value that they promise to clients. As a result, the company was seeking an integrated payment gateway that allowed it to operate a seamless, hassle-free and user-friendly bill payment system.

eMedical highlighted three (3) criteria that its preferred payment gateway provider should possess:

- The provider would offer seamless merchant account onboarding as well as long-term support for eMedical and its clients.

- The bill-pay experience would be efficient and user-friendly for both clients and staff.

- The rates charged by the provider would be competitive compared to the rest of the market.

eMedical’s Main Criteria for an Integrated Payment Gateway Solution

Seamless account

onboarding

User-friendly bill pay

experience

Low processing

rates

As straightforward as these criteria are, eMedical has had a hard time finding a processor that fits this profile. Unfortunately, over the years that eMedical has worked with various providers, none of them have completely met all of the above preferences. Instead, eMedical has routinely come across several challenges:

Challenge #1

Difficult Onboarding Process and Limited Support

Each eMedical clinic that signs on with eMedical’s integrated payments partner has had to create a merchant services account with a processing bank. However, not all payment providers have been able to provide support for the laborious onboarding process. Instead, eMedical has had to take on the burden of obtaining account onboarding paperwork, working with the medical clinic to fill out the paperwork, submitting it to the bank for underwriting, and following up on each step. This process has been inefficient and has not only cut into eMedical’s resources but has also created for a longer and more complex onboarding experience for eMedical clients.

Challenge #2

Limited, Difficult-to-Use Payment Processing Technology

Another challenge that eMedical has encountered when working with other payment solution providers has been inefficient technology that lacks important features that health clinics and their patients prefer. Without these important features, eMedical has found that its clients have had to spend more time and energy on account reconciliations, while patients have experienced frustration with the bill pay process.

Among the crucial features that have been missing from eMedical’s past payment solution providers are:

No Support for Recurring Payments and Card on File

Wellness clinics, plastic surgeons, dermatologists, and other medical providers especially prefer recurring payments. These professionals and others who provide services that are not covered by insurance benefit the most from having a secure, recurring processing system set up for routine payments. With recurring payment technology in place, clinics can set up payment plans for ongoing treatment programs or for expensive one-time treatments that the patient would like to break into installments.

Healthcare providers and patients alike appreciate the convenience of recurring payments. The patient only has to provide their card information once, and subsequent payments are processed automatically without any effort on the clinic’s part. With the help of a secure card-on-file solution and recurring payment scheduling capabilities, clinics can safely store customer payment data on file and set up custom payment schedules based on the desired amount and frequency.

Aside from its convenience, recurring payment technology also helps prevent late or missed payments.This convenience further eliminates frustration for clinics and helps to ensure a steady cash flow.

No Virtual Terminal

Lack of a virtual terminal is another limitation of the payment solution providers doing business with eMedical. A virtual terminal is an online application for keying-in any card or ACH information that’s shared in-person or over the phone. This convenience opens up even more bill pay channels for patients—whether they’re paying on-site or offsite.

Non-Integrated Terminals That Make Account Reconciliations a Challenge

Several eMedical users have opted for non-integrated payment processing providers such as Stripe or Square because of the rapid onboarding process and the sleek hardware they offer. The drawback is that these payment terminals aren’t integrated with eMedical’s processing systems and thus require manual updating of records. In contrast, an integrated payment terminal syncs transaction information with eMedical software so that clinics can bypass the manual entry process. This makes it much easier for clinic staff to monitor outstanding balances and reconcile accounts.

Friction During the Online Bill Pay Experience

To its benefit, and as mentioned earlier, eMedical’s Patient Portal enables patients to pay online. However, some of the payment solution providers that eMedical has worked with have not offered the most customer-friendly integration for their Patient Portal. In particular, some integrations have redirected patients away from the Patient Portal to a third-party web page for making a payment. Patients are often confused by the third-party website and tend to be more hesitant to share their payment information. The result is a less intuitive, more frustrating bill payment experience for the client.

eMedical’s preferred payment solution provider would seamlessly integrate its solution directly into eMedical’s Patient Portal. The customer can then pay their bill securely, without leaving eMedical’s Patient Portal—offering them peace of mind and streamlining of the bill payment process.

Challenge #3

High Processing Rates

Several payment providers that eMedical looked into offered advanced technology and a smooth onboarding experience, but their transaction rates were high. eMedical wants to be economically efficient as one of the incentives for businesses looking to adopt the company as a healthcare software provider. As a result, these exorbitant transaction fees were unacceptable since they would translate into higher costs for eMedical’s clients.

Cardknox’s Solutions to These Challenges

eMedical was referred to Cardknox by a mutual client. Once eMedical began offering Cardknox as an option to other clients, they realized that Cardknox did away with their previous frustrations. By implementing Cardknox, eMedical overcame all of its significant challenges that other payment processing solutions had failed to resolve in the past:

Solution #1

Easy Onboarding Process and Dedicated Client Support

Cardknox’s internal support teams manage every step of the onboarding process, alleviating the burden from the eMedical team. With its 20+ years of experience, relationships with several processing banks, and extensive industry knowledge, Cardknox can set up merchant processing accounts in a lot less time. eMedical no longer has to worry about overseeing the onboarding process and they can onboard clients far more rapidly than before.

Solution #2

Cutting-Edge Payment Technology

As a payment solution provider for hundreds of health clinics across the country, Cardknox is closely attuned to the industry’s needs. Additionally, the company has always had a forward-thinking approach. Their innovative attitude has put them consistently ahead of the curve when it comes to payment technology.

Cardknox’s feature-rich software has equipped eMedical’s clients with the tools they need to improve their business operations as well as their patients’ experiences. Furthermore, Cardknox works closely with each client and is receptive to product development requests.

Cardknox Payment Features

Cardknox’s inclusion as a payment solution provider has brought eMedical’s clients access to several critical features, including:

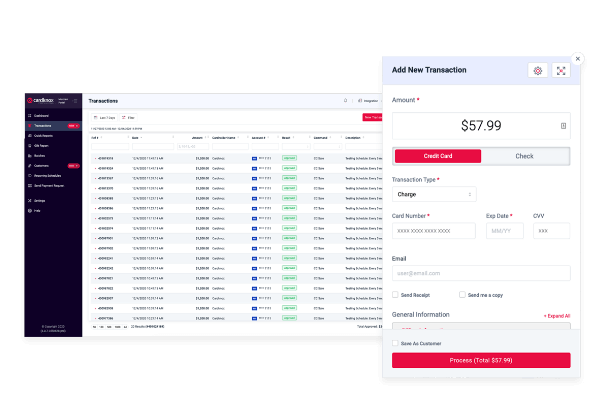

User-Friendly Virtual Terminal

The Cardknox Merchant Portal is a web-based virtual terminal application with an intuitive layout and a rich feature-set to allow for easy management of payment activity. Not only has this utility equipped eMedical clients with a secure and easy-to-use platform for keying-in payment information that’s shared in-person or over the phone, but it has also provided several other exciting benefits. For example, users of the Cardknox Merchant Portal can monitor transaction data, generate reports, store customer payment information, send email invoices, set up custom recurring payment schedules, and much more.

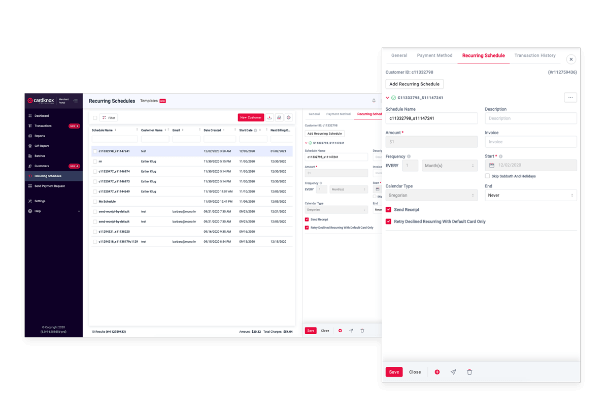

Support for Recurring Payments and Card on File

With the help of Cardknox’s recurring processing solution, clinics can easily create payment plans with a specified amount, frequency, desired run date, payment method, and several other criteria. Cardknox’s recurring payment scheduling functionalities can be controlled by clinics directly through the Cardknox Merchant Portal. Alternatively, software developers can access and utilize recurring payment functionality through the Cardknox API.

Support for Recurring Payments and Card on File With the help of Cardknox’s recurring processing solution, clinics can easily create payment plans with a specified amount, frequency, desired run date, payment method, and several other criteria. Cardknox’s recurring payment scheduling functionalities can be controlled by clinics directly through the Cardknox Merchant Portal. Alternatively, software developers can access and utilize recurring payment functionality through the Cardknox API.

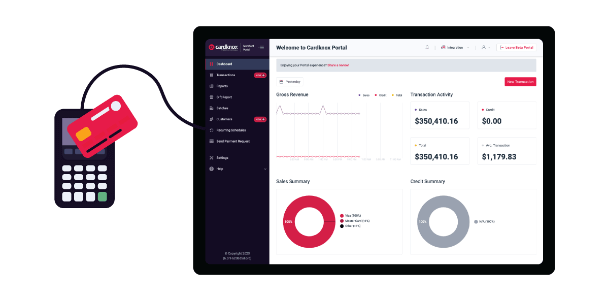

Integrated Payment Terminals

Cardknox is compatible with a wide range of payment terminals from brands like Ingenico, ID TECH, and PAX that support leading payment types: EMV quick chip, magnetic stripe, contactless, mobile wallets, and more. By integrating with Cardknox, eMedical’s clinics can enjoy streamlined account reconciliations and the flexibility to pick the right terminal that suits their needs.

Frictionless Online Checkout Flow

Several alternative payment solution providers redirect users away from the integrated software to preserve the security of transactions. If users have to submit information to the client’s server first, then steps must be taken to ensure that malicious users won’t intercept this data. In response to this challenge, Cardknox developed its iFields technology which enables developers to embed Cardknox payment processing fields directly into the online payment flow. Thus, eMedical users who integrate with Cardknox can offer patients a frictionless bill pay experience on the eMedical Patient Portal.

Solution #3

Competitive and Transparent Processing Rates

Cardknox’s extensive industry relationships, breadth of knowledge, and advanced technology enable them to provide clients with the most competitive processing rates. Through their experience in the healthcare industry, Cardknox has further refined their competitive pricing for industry clients.

In addition to their industry knowledge, Cardknox also has its own Interchange Qualification Monitoring (IQM) technology, which routes each transaction for the lowest cost.

Clients have the option of choosing either flat-rate pricing or traditional fee-based pricing. No matter which model the independent software vendor (ISV) or client opts for, rates are clearly shared with the client upfront and there are no hidden fees.

Conclusion

Medical clinics have a lot on their plates when it comes to managing their patients’ care and the overall flow of payments. By integrating their medical practice management software with a feature-rich payment gateway like Cardknox, clinics can alleviate much of the burden of standard billing operations such as manual entry of transaction data, tedious account reconciliations, complicated checkout flows, and declined or missed payments. eMedical Software has benefited tremendously from working with Cardknox: a committed payment solution provider that’s there every step of the way to support eMedical, its users, and their patients.

Client

eMedical Practice

Website

www.emedpractice.com

Industry

Healthcare

Payment Acceptance Platforms

- Registration Kiosks

- E-Payments

- Patient Portal