How To Go To Market as a PayFac: A Guide for ISVs and VARs

Sabine Konhaeuser2023-06-20T12:41:43-04:00

As an ISV or VAR, acting as a PayFac comes with many advantages, including more control of the payment experience, faster merchant onboarding, and an additional revenue stream generated from payment processing profits. As different iterations of the PayFac model have come to market, many ISVs are choosing the PayFac-as-a-Service (PFaaS) model since it offers the same benefits but without the initial capital outlay and the long wait for a return on investment.

PayFac providers come in many forms, however, and not all are created equal. Once you get past the sales presentations and revenue projections, many leave you high and dry—letting you figure out the details like pricing, how to drive adoption among your customer base, and how to support end users. ISVs and VARs need a partner that is willing to not only support the launch, but bring a level of excellence to the program that turns payments into a differentiator for your business. The technology may be amazing, and the revenue split incredible, but without a partner that is invested in your ongoing success, your journey to becoming profitable may be slow and arduous.

In this white paper, we’ll explain the best practices for going to market as a PayFac, including choosing the right PayFac-as-a-Service (PFaaS) partner to help you hit the ground running, planning a successful launch, creating a seamless onboarding experience, and running ongoing marketing programs.

Read the full white paper anytime and anywhere.

Choose a PayFac Partner That Can Help You Succeed

Going to market as a PayFac begins long before you launch your payment offering to your customer base. It actually starts during the buying process as you look for a PFaaS provider. How your provider supports you is just as important as many of the other factors you consider during your decision process. Your provider should be an extension of your sales and marketing efforts, helping you strategically launch your payment program, give onboarding guidance, and ensure you and your clients have the technical support and marketing tools needed to succeed. Here are a few examples of the type of support you should expect from your PFaaS provider:

Support for Your Development Team

Your PFaaS provider should play an active role in assisting your development team with the initial integration. This process doesn’t have to be a hassle when there is guidance from an experienced team of developers. Tried-and-true providers will have implemented many integrations and have the expertise to handle complex configurations.

Sales Support

A provider with an inside sales team will allow you to focus on your key business objectives while your clients receive personalized service regarding any payment program questions. Be sure to ask how much time your provider can dedicate to your company.

Marketing Strategy, Tools, and Templates

Marketing is an important component of your success when you go to market as a PayFac and will complement inside sales efforts. Your provider should offer a basic outline for your marketing strategy, including various templates for email campaigns, landing pages, and brochures.

Education for Your Clients

Your provider should also assist with live or pre-recorded education for your clients, whether it’s training on chargebacks or actual product training. Guides and cheat sheets also offer value so customers can self-serve where possible.

Pricing Strategy

Industry veterans have experience navigating typical pricing structures across multiple industries. Your provider should be able to guide you on the buy rates (base cost) and markups for your particular market to ensure your payments program is competitive. In many cases, PayFac providers can guide you on a flat-rate price that offers transparency and simplifies reconciliation for your merchants.

Before You Go to Market as a PayFac, You Need a Strategy

A go-to-market (GTM) strategy is a step-by-step plan for launching a new product or expanding an existing product into a new market. It answers the question of who you will market to, what you will offer, where you will offer it, and how you will reach your target customer. It’s important to document your strategy because it needs to be clear and repeatable. And you’ll be setting yourself up for success. Marketers who document their strategy are 538 percent more likely to report success than those who don’t. That’s huge.

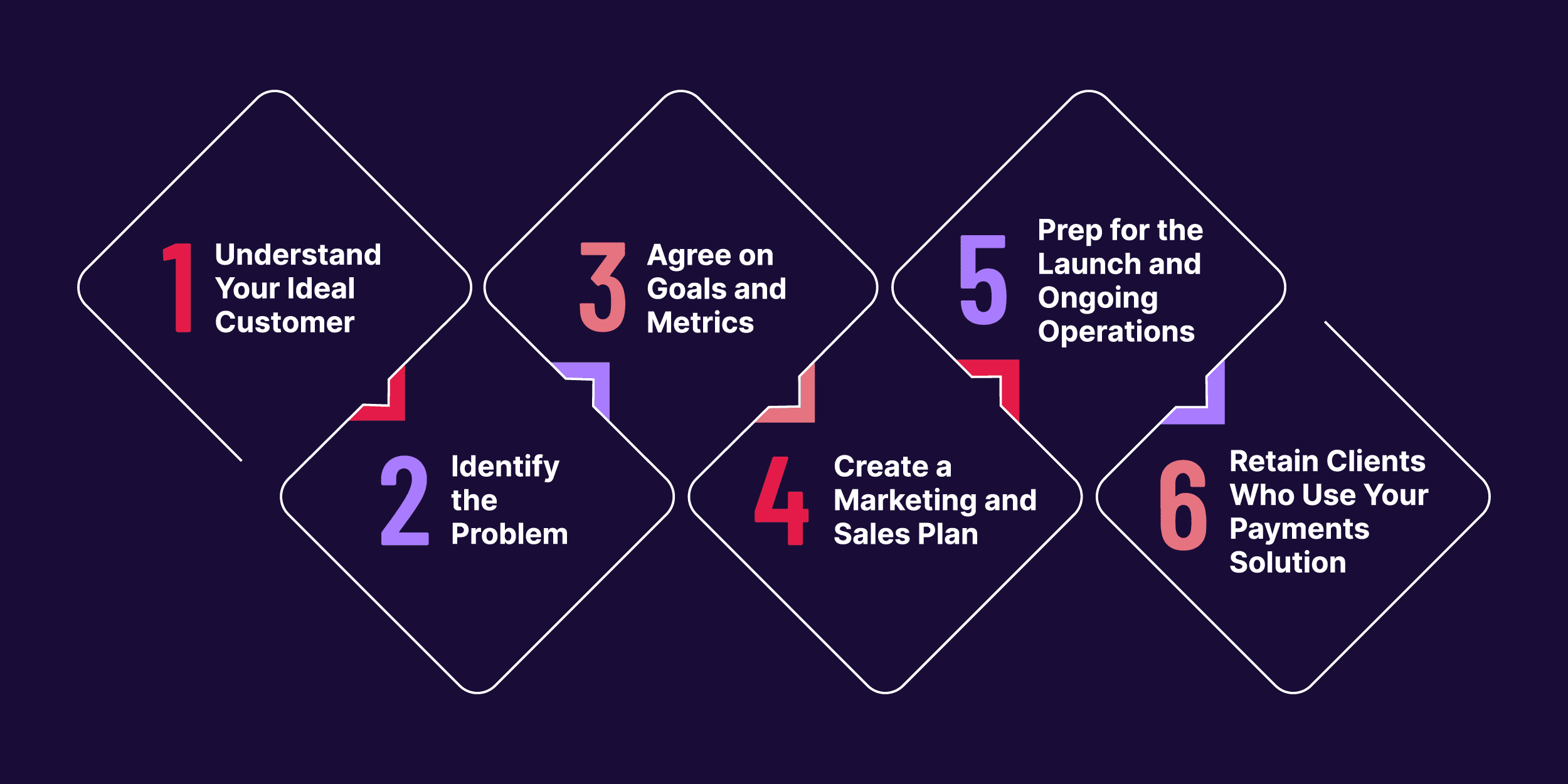

So now that you understand what a go-to-market strategy is at a high level, let’s break it down into steps.

1. Understand Your Ideal Customer

This step shouldn’t be too difficult for ISVs or VARs since you’ve already sold your client once and likely know a good deal about them. The best marketing practices dictate that you should document your ideal buyer using a buyer persona—or fictional client that represents the different types of buyers you serve. Buyer personas serve as a guide so that you can nail down your client’s demographics, pain points, role, and more. This process could be helpful if you’ve never done it or if the person in charge of making payment decisions isn’t the same person as your original buyer or user. That way, you have a better idea of who you are marketing your payment program to.

Buyer personas also help you identify different segments within your overall audience—meaning you could choose to focus on a subset of clients that are grouped by a variety of characteristics, such as overall revenue, number of transactions, transaction volume, or average ticket price. Maybe you’d like to focus your efforts on the clients with the highest processing volume, for example. Or perhaps a targeted “switch” campaign—based on your clients’ current payment provider—makes the most sense, since this way, you can focus on differentiators and a possible exclusive offer for changing over.

2. Identify the Problem

Your PFaaS provider will help you identify the challenges your clients face in regard to payments. Knowing their biggest pain points will guide your campaign messaging and the features to highlight. For example, if your clients are using payment provider XYZ for processing, but that provider is not integrated with your software or application, you can hone in on the ease of use you offer through embedded payments. Likewise, your client’s current provider’s rates may be more expensive than yours. Promoting the fact that you can save your clients a significant sum presents them with a great motivator to switch.

3. Agree on Goals and Metrics

Before you go to market as a PayFac, it is a good idea to set a goal to define success. Your provider should be able to recommend realistic metrics and targets. Some common examples include adoption rate, retention rate, total processing volume, and the lifetime value of customers. Using metrics like these will allow you to measure your efforts over time.

4. Create a Marketing and Sales Plan

Once you have goals in place, you can determine the best tactics to help you achieve them and create a calendar for planned campaigns. As mentioned, your provider can supply templates to get you started, including email campaigns, fliers, and landing pages to convert your users. A solid payments partner can also suggest special incentives and offers that have been successful in the past, such as waiving sign-up fees or a monetary credit for each client after they meet a specific processing volume.

Your payments partner can also offer sales support that complements your marketing efforts. A dedicated team of payment experts that reaches out to your client base and explains the offering allows you to focus on your primary business.

A successful go-to-market plan must also include quick and easy onboarding processes so your clients can apply for payment processing with little help from you. Using an online form linked from or built into your application creates less friction than traditional written forms. Help your clients get up and running with videos, written tutorials, or live training from your payment provider. And when considering onboarding policies for your core application, it is also an option to offer your payment services as the only choice.

5. Before You Go to Market as a PayFac, Prep for the Launch

A go-to-market strategy has many moving parts. Give yourself plenty of time to create the plan, as well as the processes that must be implemented before you launch. Tasks must be delegated to your internal team members, and procedures must be defined. A true payments partner can help you map out the details of the launch plan. They can also address issues you may have yet to consider once your program is underway, like how to assess each client’s risk, spot fraudulent transactions, and deal with chargebacks.

6. Retain Clients Who Use Your Payments Solution

In the software world, retention is everything. Once your client signs on to use your payment program, ensure they continue to do so by offering advanced training, regular check-ins, and stellar support services. A drip email marketing campaign is an easy way to send successive training or spotlight payment tips in your client newsletter. Use your established check-ins with customer success as another opportunity to ensure positive payment experiences. And for customer support, be sure your payment provider is well-staffed with experts to step in when needed.

Conclusion

Just as you plan sales, marketing, onboarding, and growth strategies for your primary offering, the same is true for payment services. While a go-to-market strategy may sound like a lot of work, so is going to market without a plan and struggling to find your way. Choosing a seasoned PFaaS partner that can provide access to tools, resources, and expertise puts you on the path to success.

Cardknox Go

Cardknox Go is an out-of-box PFaaS solution that equips businesses with everything they need to become a PayFac: software, compliance, risk monitoring, and more. With Cardknox Go, there’s no need for a large upfront capital investment, high levels of risk exposure, or complex infrastructure like traditional payment facilitator models. And as a Cardknox Go partner, you receive best-in-class sales, marketing, and customer support from industry experts who only succeed when you succeed. Take your payments to the next level. Visit www.cardknox.com/cardknox-go to learn more, or contact us today to begin your journey toward PFaaS.

Read the full white paper anytime and anywhere.