The Power of Mobile POS Integrations for ISVs and SaaS Providers

Varone2022-07-07T19:05:35-04:00

The COVID-19 pandemic turbocharged merchants’ interest in mobile point of sale (mPOS) systems. mPOS untethers traditional POS solutions from fixed stations, allowing employees to collect payments via mobile devices like tablets and smartphones — often with no physical contact with customers. In a pandemic, that’s a big advantage. After a slow start about a decade ago, mPOS systems have become increasingly popular in the last few years. In fact, NTT Data and Accourt Limited estimate that mPOS transactions will total $4 trillion, or half of all POS volume, in 2024.

This will be a boon for the independent software vendors (ISVs) and software-as-a-service (SaaS) providers that develop and deliver the systems. Juniper Research thinks faster adoption will drive annual spending on mPOS systems to $1.7 trillion in 2024, as merchants realize the value of solutions that are increasingly integrating key technologies like mobile payment processing, inventory management, and CRM.

This white paper will review the current state of play in mPOS development, explore how payment technology innovations are driving some of the most significant changes, and discuss how ISVs and developers can embark on the mPOS journey.

Read the full white paper anytime and anywhere.

What is a POS System?

A traditional countertop POS system’s most basic function is the same as an old-fashioned cash register: it allows a company to collect payments for its products and services and keep track of transactions. However, POS systems are much more sophisticated — they can also scan prices, read credit cards, manage customer relationships and inventory, generate gift cards, liaise with reporting and budgeting software, and even handle some marketing functions. Many work in tandem with companies’ existing operational systems. For example, a merchant could integrate a POS system with an existing third-party CRM product like Salesforce.

The basic components of traditional POS system hardware are what you see at the end of a checkout line at a retailer or supermarket: a keypad, product price code scanner, credit or debit card reader, cash drawer, and receipt printer. The software can reside locally, in a web browser, or in the cloud.

mPOS: The Next Step Forward

The adoption of mPOS systems did not begin in earnest until the launch of the iPad in 2010. Prior to that, specialized mPOS units were available but expensive. Square was an exception. It launched in 2009 and could be used with an iPhone. The company gave the units away and took a small fee per transaction.

The mPOS approach received a boost in 2012 when large retailers such as JCPenney and Sephora decided to use tablets and smartphones as mPOS platforms. Some companies, such as AT&T, said they would eliminate static countertop POS systems altogether. Apple, using its own iconic hardware, was the first big company to do so in its network of retail stores.

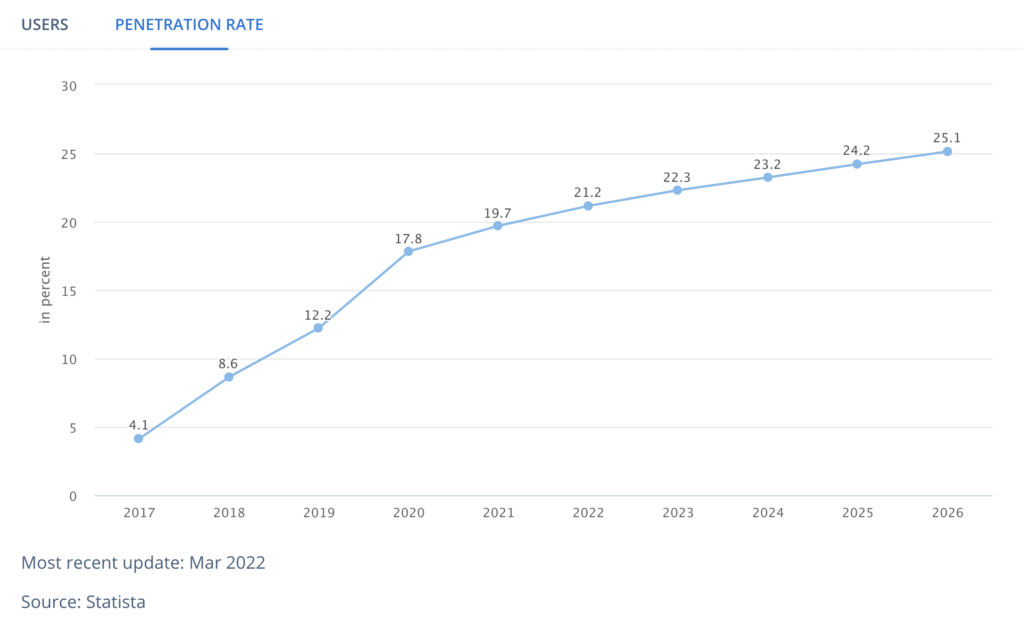

The worldwide mPOS adoption rate languished for several years until it picked up momentum in 2017. It rose from 4.1% that year to 19.7% in 2021. Statista projects that it will account for 24.2 percent of user transactions in 2025, with the average annual transaction value per user reaching $2,474.

Graph 1: mPOS Adoption

There are several drivers behind the recent uptick in mPOS adoption. Of course, the pandemic vastly reduced the bulk of foot traffic in brick-and-mortar establishments and prompted merchants to consider their own safety. That made them more eager to improve their customer experience even after the lockdowns were lifted. Importantly, mPOS systems have kept people from having to queue up in front of a cash register, which makes customers and employees more comfortable even as the pandemic subsides.

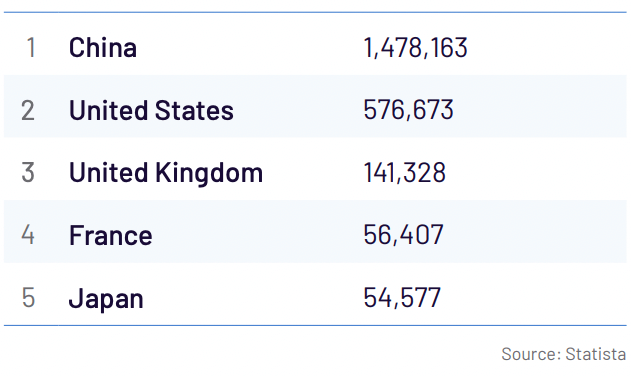

Merchants have also sought ways to respond to initiatives by governments and banks in many countries designed to move toward more cashless economies. This is one reason why the growth of mPOS technology adoption among small enterprises in China has been notable (see Chart 1). Also, developing markets such as India are showing signs of rapid adoption growth as small merchants embrace the technology. Nonetheless, transaction value growth in the U.S. will blaze past even the fastest-growing markets like India. The U.S. will see a compound annual growth rate (CAGR) of 20.39% between 2022 and 2025, compared to a worldwide CAGR of 16.10%, according to Statista.

Growth in many economies, but especially among cash-strapped merchants in the developing world, will be boosted by the move toward tap-to-phone solutions that do not require any extra hardware. They take advantage of credit and debit cards’ embedded NFC chips, which can be read directly by a mobile phone that has installed tap-to-phone software. A growing number of industry players like MagicCube and more recently, Apple, are rolling out tap-to-phone software solutions.

Chart 1: Transaction Value Geographic Comparison

Top 5  (2022) in million USD  (US$)

Benefits For Adopters of All Sizes

The rate of adoption of mPOS by retailers appears to be size-agnostic. Large merchants find the technology cost-effective since it can empower floor sales staff to act as checkout clerks on the fly, reducing full-time employee costs. Micro-merchants or businesses that spend time away from a brick-and-mortar location or office — such as food trucks and plumbers — find mPOS useful because it reduces the need to handle cash or spend valuable time on non-revenue producing activities like generating and chasing after invoices. Small operators also like it because of its low costs, ease of onboarding, and transparency.

Looking forward, developments in biometrics, increasing utilization of contactless transactions via digital wallets like Apple Pay and Google Pay, and the growing use of EMV chip (Europay, Mastercard, and Visa) technology are going to drive growth, according to a January 2022 report by Global Industry Analysts (GIA).

GIA estimates that the market for mPOS systems — both hardware and software — will grow at a CAGR of 14.5% between 2022 and 2026, reaching $46.2 billion. The firm expects hardware to grow at a 14% CAGR, and to continue to account for the bulk of revenues from mPOS installations. Software, which the firm says now accounts for 20.5% of mPOS installation revenues, will grow faster, notching a 16.4% CAGR.

The Characteristics of mPOS Solutions

There are several core functionalities that mPOS systems have in common. mPOS software is cloud-based or offered as a SaaS, featuring a rich array of tools. mPOS software typically offers payment processing capabilities, sales reporting, transaction adjusting, and emailing of receipts and invoices. Most also allow merchants to check inventory on the fly. More sophisticated systems provide CRM, accounting, and reporting functions, and can, as noted above, be integrated with third-party or existing in-house software that merchants use for those activities.

To enable payment acceptance, mPOS solutions also feature a card reader that can be paired with mobile devices via Bluetooth or an audio jack. Most often, these readers include a magnetic stripe reader for reading a credit card’s magstripe, an EMV port for reading a credit card’s embedded chip, and a near-field communication (NFC) device to communicate with a customer’s mobile wallet or contactless card. Some also have a QR code reader.

Some of the better-known mPOS providers include Cardknox, Square, Lightspeed, and Clover. These providers generally have nominal monthly fees or no monthly fees, and they charge around 2-3% per transaction.

The Benefits of mPOS

Apart from the advantages articulated above, mPOS offers a number of advantages over traditional POS systems:

- Customer Experience Benefits

mPOS systems make the shopping experience easier and more enjoyable, increasing customer loyalty and spending. They eliminate long lines at cash registers, and they provide a sleeker, more modern checkout experience. And, they cater to customers’ growing comfort with mobile payments.

- Cost Benefits

mPOS systems are less expensive than traditional POS software and hardware. They also can reduce expenses by lowering the number of employees needed to staff checkout lines.

- Logistical Benefits

mPOS systems are very easy to implement and learn, and smaller merchants can use them almost immediately. Their hardware and software components are much more streamlined and simple to operate than traditional POS systems. Plus, they are ideal for on-the-go businesses like food trucks, moving companies, home repair professionals, and so on.

These benefits add up to a stronger top-line performance. mPOS systems demonstrate a tangible effect on revenues. An IHL Group and NCR survey from 2017 found that retailers who used mPOS systems enjoyed 92% higher sales than those that did not.

How Mobile Payment Integrations Bring Value to mPOS

Payment processing is the central function of mPOS solutions. While there are many complete, standalone mPOS solutions on the market that perform payment functions, mobile payment integrations open up even more opportunities for businesses to utilize tailored mPOS technology. These custom solutions allow merchants to seamlessly manage their operational needs — such as fleet management, inventory management, or CRM — alongside payment acceptance. By centralizing all these essential tasks within one mobile-based software, business owners and their employees can enjoy greater workflow efficiency.

Today’s ISVs and SaaS providers have tremendous opportunities to build mPOS systems that cater to clients’ needs. The principal benefits of mobile payment integrations include:

- Seamless Account Reconciliations

A fully integrated mPOS solution syncs payment acceptance with sales data and invoicing, making it easier for businesses to perform accounting duties and reconcile accounts.

- Flexible Invoicing Tools

Many mobile payment integrations give merchants access to an invoicing tool that can be used to send out pre-filled invoices and set up recurring payment plans.

- Powerful Data and Reporting

Businesses today want to be able to keep tabs on their sales data, wherever they are. Fortunately, today’s mobile payment integrations can equip mPOS software with advanced reporting capabilities. From the palm of their hand, users can generate custom reports, view open and closed batches, filter through past transactions, and much more.

- Improved User Experience

Rather than having to switch back and forth between a POS system and third-party payment app or terminal, mobile payment integrations bring all these tools together in one place.

The Cardknox mPOS Solution

As a leading omnichannel payment platform, Cardknox offers a standalone mobile app — the Cardknox Mobile App — as well as several mobile integration options for building custom mPOS software. Developers who integrate third-party apps with Cardknox are able to equip their apps with all of the same advanced functionalities that are available in the Cardknox Mobile App for iOS and Android.

Cardknox’s Mobile App features a wide range of tools for managing payment activity. Merchants can key in or capture card information using their camera, or they can swipe, dip, or tap payments using the compatible card reader with Bluetooth and audio jack connectivity options. In addition to payment processing, Cardknox’s mobile solution makes it easy to monitor sales data, adjust transactions, manage invoices, and more. Users of the app can:

- Instantly locate and view past transactions with easy search and filter tools.

- Quickly and automatically send email receipts.

- Adjust, refund, and void transactions with just a few clicks.

- Generate powerful, on-demand reporting and analytics.

- Schedule and process recurring transactions for predictable and on-time payments.

- Securely store customer payment information.

- Keep sensitive data off of merchant servers and remain out of scope with built-in PCI DSS compliance.

The Cardknox Mobile App features advanced data tokenization and is fully PCI compliant. Plus, it syncs with the Cardknox Merchant Portal web application so that merchants can enjoy a full suite of payment tools whether they’re at their desktop computer or on their phone.

Building Custom mPOS Solutions With Cardknox

Merchants who implement custom mPOS software have much to gain, as discussed above. Cardknox offers several mobile integration options so that developers can build solutions with incredible ease:

- Mobile SDK

The Cardknox Mobile SDK features all the tools and programs that developers need to integrate Cardknox payment processing capabilities directly within third-party iOS or Android apps.

- Mobile Deep Linking

Cardknox Mobile Deep Linking allows developers to integrate Cardknox with third-party apps with next to no development work. Rather than having to build a full integration, the developer simply embeds a link to the Cardknox Mobile App within the merchant’s point-of-sale app. Once this is done and the Cardknox Mobile App is downloaded onto the merchant’s device, the merchant can collect payments through their app via a simple redirect.

Prepare for the Future of Payments With mPOS

Technological advances are making it easier than ever for merchants in every industry to access advanced POS tools right from their mobile devices. As adoption of this new checkout model rapidly picks up, now’s the time to future-proof your business.

The Cardknox approach brings ISVs and SaaS providers many advantages: competitive residuals, ease of integration, omnichannel solutions for every sales channel, and much more. Contact us today to begin your journey toward the new era of mPOS.

Read the full white paper anytime and anywhere.